Home Financing Personal Credit and Business Credit Credit Report and Credit Score Analysis

Credit Report and Credit Score Analysis

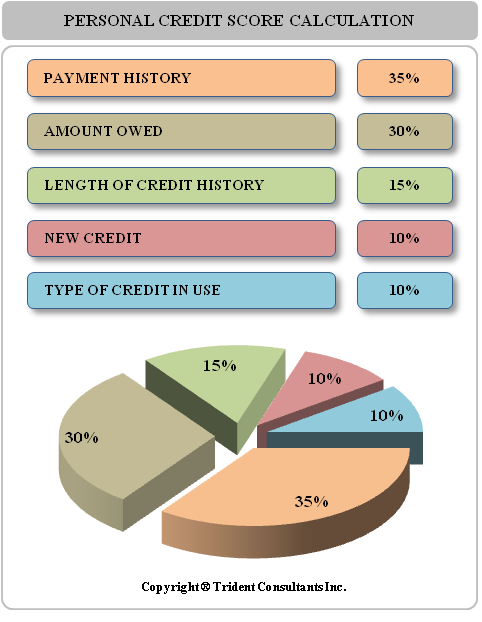

Of the five types of information used to calculate a FICO® score at any given point in time the attached chart will show the weight given to each type of information when calculating a total FICO® score. These percentages are based on the importance of the five categories for the general population.

For particular groups, such as people with relatively short credit histories, the importance of the categories may differ. Inquiries are a subset of the "new credit" category shown above, which accounts for 10% of the total FICO® score. Their importance depends on the overall information in your credit report. For some people, a given factor may be more important than for someone else with a different credit history. In addition, as the information in your credit report changes, so does the importance of any factor in determining your score. What's important is the mix of information, which varies from person to person, and for any one person over time. For more detailed information please contact www.fairisaac.com

7. For those who have no credit history

Many folks do not have any or very little credit historyand there are many reason for that. If you were not born in the United States and emigrated over here later in your life, you probably don’t have any credit history since you did not have a social security number. But often people born in the United States may have little or no credit history because they have never applied for credit.

We believe the following steps are the best way for a person without credit to start building credit:

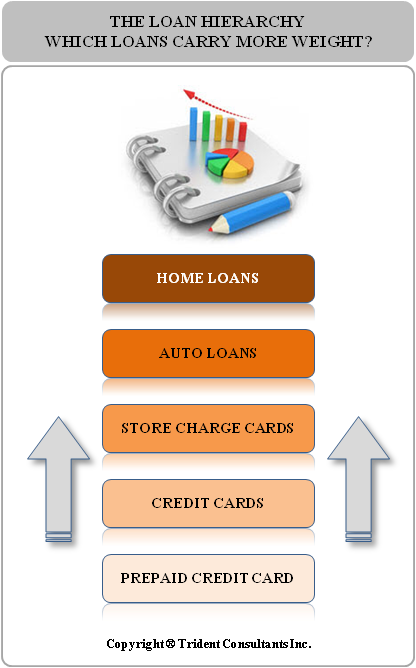

- Prepaid credit cards: A prepaid credit card allows the you to pay the lender ahead of time and fill up the card with ‘credit’ that you can in turn use when you use the card. These lenders often team up with either Visa or Mastercard and so you have the ability to use the prepaid credit card at any location that accepts Visa or Mastercard. Eventually you can use your spending history with the lender to request them to give you an actual credit limit and that his how you start building your credit history.

- Store charge cards: Cards from department stores like Sears, Macy’s and others have been known to be relatively easy to procure and the reason for this is that store charge cards require the borrower to pay off the balances much quicker than traditional credit cards so while the store is extending credit to you it is doing so at much more conservative terms than say a traditional credit card lender. Thus by using charge cards for a while you can develop a solid credit history and use that to apply to larger credit card lenders later.

- Credit Cards: Once you have some established credit history with prepaid credit cards and store charge cards, many lenders will start offering you credit cards although with small lines of credit. If you do well with small lines of credit eventually your credit limits will be raised by these lenders.

- Auto loans: Not as easy to get as credit cards, auto loans require that you have some established credit history since the average auto loan is at least $7000 or more. Auto loan lenders want to make sure that they are lending to someone who has an established credit history.

- Home loans: The toughest loan to obtain is a mortgage. A mortgage of course requires that you show proof of income, assets, solid credit history of timely payment on at least 3 to 4 accounts for over two years. Once you get a home loan and make timely payments for an year or so, you will find that your credit scores improve dramatically.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.