Home Starting a Business Free Incorporation Guide - Sole Proprietor

Free Incorporation Guide - Sole Proprietor

The choice of entity and business structure that determines how you as a business owner will conduct your business is very important. There are many options available to the business owner who is looking to begin a new business enterprise or even to someone who is buying an existing business. Keep in mind that the laws and rules governing the different types of entities vary from State to State. Before making this choice we highly recommend that you consult with a CPA (certified Public Accountant) and a qualified attorney. There are many significant implications in the selection of business entity under which you will operate the information presented in this section is only to give the reader a general idea of the type of entities that are available.

The main types of business entities that you can operate under are:

- Sole Proprietor

- General Partnership

- Limited Partnership

- Limited Liability Partnership

- S-corporation

- C-corporation

- Limited Liability Company

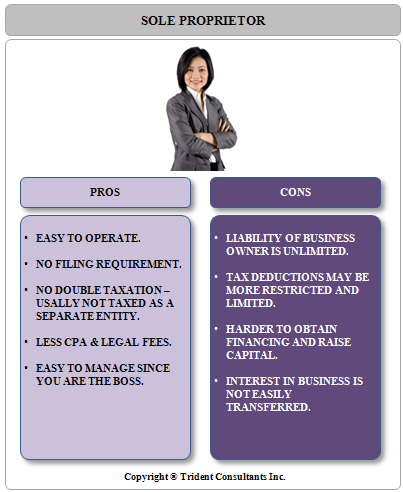

1. Sole Proprietor

This is the most common for of business ownership and operations. When you elect to remain a sole proprietor you do not have to incorporate with any state or federal agency – simply hang up a shingle and go to work. You will still need to have the necessary business licenses to operate your business – for example if you are an electrician, your state and county will probably require you to be a licensed electrician. Sole Proprietorship is very common amongst businesses that have fewer than five employees in businesses that serve small local communities. The business owner also has the ability to file a DBA (doing business as) certificate with the county in which they conduct business so John Smith who is an electrician may be able to file a DBA certificate and do business as Smith electric as long as nobody else has filed a similar DBA in that jurisdiction.

The benefits of sole proprietorship are that there is no double taxation, you file taxes as an individual and all your business income is directly reported on your personal income taxes. There is obviously no cost to create and maintain a separate legal entity and so you don’t have to pay a CPA (certified public accountant) to maintain books and file taxes separately since everything is done under your name.

A sole proprietor however cannot transfer his interest in his business to another person and the business will automatically dissolve in the event of his or her death. One of the greatest concerns for sole proprietors is that they are personally responsible for any and all liabilities that may arise during the course of their business – thus if the business is sued by a client or vendor, the personal assets of the business owner are on the line. We highly recommend that in these litigious times, business owners select the option of operating as a sole proprietor carefully.

Lenders are also not very excited when they are looking at a sole proprietor when making lending decisions since their loans could easily be at risk in the event of a lawsuit – it is often much harder to raise capital as a sole proprietor.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.